Psychology and Trading

Trading is, above all, psychological

It is quite possible to control your emotions while trading, I have already mentioned the fact that a good trader is a calm and cool person. Are you cut out to be a successful trader ?

In fact, if you're excited by your trading, or you are looking for a dose of adrenaline, you will definitely not trade well; you will be less lucid and the first mini stock market crash will sink you and your portfolio. But the controlling or channelling of your emotions has a price, and trading is no longer "fun” ;)

How to control your emotions and trade ?

It took me 12 years to get there; to find a kind of trading that generates no extreme feelings in me (which does not mean that I am emotionless. I am a human being, but it is neither those emotions nor the quest for adrenaline which consciously or unconsciously govern my trading).

That is why I do scalping: duration of trades less than 30 seconds, maximum loss €100, will not generate me a lot of stress, and represents 0.x% of my capital. Number of trades per day between 30 and xxx, which makes it very repetitive, and I get bored trading (that is why I am efficient; trading no longer gives me a feeling of pleasure or displeasure, I'm looking for just efficiency and I write blogs in parallel to fight against boredom). At the end of the day, I find out how many losing trades I have had, and they are forgotten by concentrating on the next trade that can arrive in the next minute.

In short, I started earning money in the stock market when it was no longer a game, and when I was no longer looking for my dose of adrenaline, when I understood why I wanted to trade in the stock market (and not just earn money). Now I get bored in the stock market, as I found a system to counter my psychological weaknesses: it is a trading that suits my psychological structure. For example, the repetitiveness of scalping prevents me from brooding over my losses; profits or losses are in my unemotional area (€100)...

I was often "attacked" on trading forums, on my trading style: "You made €10, that’s nothing, you are lousy, me I made €1,000 etc.” In effect, scalping unlocks trading without emotion, repetitive, boring, but effective. This is uncomfortable because it can subconsciously reflect on those who trade primarily to experience emotions, to feel alive (regardless of winning, a gain is strongly felt and a loss makes them sink, but if you feel these emotions, you are alive) and not foolishly making money to improve a dull routine.

If I was swing trading by using leverage as I was able to in the past… I would surely not be able to sleep, I would feel alive from all the feelings that I would have, and the risk of the final "tilt". I would end up like all players, by losing everything but ultimately that would be a great thing (the emotions), and it is because of this that players, traders want to "go again!”

In short, a successful trader follows Socrates' maxim: "Know thyself" to be a good trader 😉

Adrenaline is not related to Trading

Finally, adrenaline is not linked to trading, but to a personal representation of money, of loss, a taste for risk... I make €100 or lose €100, this does not change anything in my life. I accept losing and winning, they give me no joy or sadness. If I wanted to feel like that I would gamble in a casino, or play on-line poker, etc. with very minimal sums

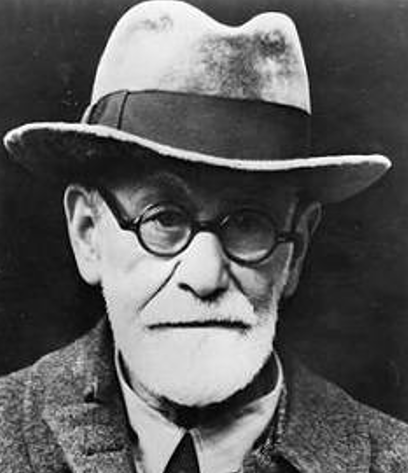

Because of this, trading is above all psychological and the main job is to work on yourself, do a psychoanalysis for example to understand a lot of things about yourself, money, loss, your surname, and how to manage your superego which is involved in trading…

Of course, this is a little extreme, but I can assure you that some people try to lose money in the financial markets to have something to complain about, and other people feel bad when they earn on the markets... and there is always a reason. I am always surprised, even if I know why, to see the pleasure people get from telling their retrospective stories of trading losses, during a crash for example. There is enjoyment in the fact of still being there, to have survived.... There is no doubt about it, they postponed death, they survived, they are alive... and a gain will never give them this feeling... one of having triumphed over death, the only real fear that we have and that we fight every day. It is due to this that 90% of traders lose... but this would lead us to write a blog on psychoanalysis and not on trading.

Trading is an addiction like any other

Trading can be an addiction like the casino game etc. I knew a trader (not me) who punished himself with his trading losses; he was subconsciously trying to lose money because he was sinking psychologically and that is what he was looking for (like an alcoholic, a drug-addict etc). There is always a conscious or unconscious reason that pushes a drunk to drink, a drug-addict to shoot up, a trader not to take his losses despite his trading plan... Trading is more socially acceptable than taking drugs, but the cause of addiction is the same. Here, you need to find out why.

There are hundreds of exciting books which are accessible to the general public on gambling addiction, on the fact that the casino player who wins continues to play, knowing fully well that he will lose ... substitute the casino player with the trader and you will have a book on trading, they look for the same emotions, they play for the same reasons ... it's all about the same resiliency.

In short, becoming a trader is discovering what lies deep down in you and trying to channel it... trading "methods" never take the psychology of the trader into account. In fact, a book should be written for each person ... This is why I often say: "there is no trading method, each trader has his/her own method adapted to his/her psychology ...” In short, write your own book on trading.

Why do I trade CFDs and Futures at the same time?

Why do I trade with ProRealTime CFD and ProRealTime Futures?

Try a Free Demo Account or a Real acount

No comment for Psychology and Trading Be first !